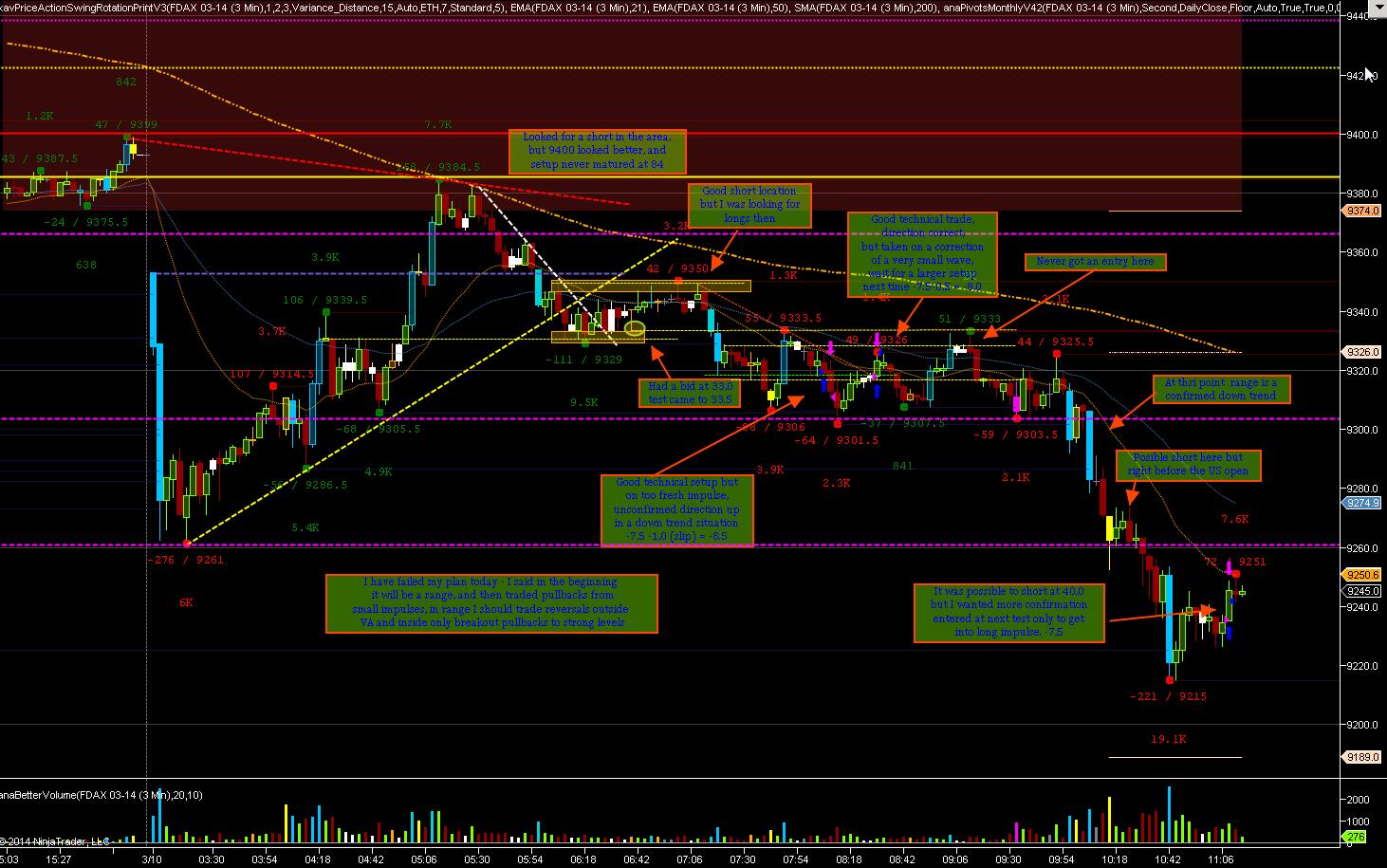

During this run there were hardly any entries up, plus I was looking for a short once gap gets closed. I was targeting area 9400. But it never got there. It printed double high there but it was too volatile for me to enter. I could not get an entry for my risk of 15 ticks.

I had a feeling it could climb up more, so was looking for long entries. The first stop did not give me a setup. The second one printed a setup as per my system, but I could not get in. I had a pending bid at 9333 and it came to 1 tick off it. I was way too careful with this entry. It never made a great runner but had plenty of exit points and would be a safe trade.

Market made another leg down but I was still looking for a long. After an impulse up I was committed to enter on a long. Once it pulled back it printed a quite decent entry long. I took it.

|

|

It made just 1 tick of draw down and came into profit. It had produced 7 tick profit or so, it was way too early for me to put to break even, but I could have reduced my risk, moving stop to the recent lows. But I kept it at default 15. Then it came roaring down, giving hardly any opportunity to limit my risk. It stopped me out and gave 2 ticks of slippage for -17.

At this point I could see the exhaustion of the move up and started to look for shorts. Last impulse down was larger than a previous one and I called for a resumption of a down trend. A short setup came along the way. I was decent.

The only problem with it could be that we did not get any break of the pullback TL, but it printed multiple top high consolidation and usually it is a very good entry point for a pullback when contracting triangles don't break on their flat part but reverse. But no chance here. It went straight into red and gave no chance to reduce the risk. It proceeded to my stop, slipped me 1 tick and reversed there. Even if I had an entry 2 ticks higher and would be still in the trade, it wasn't a runner I was looking for. But it would give 20-something ticks and would certainly not be a loser.

By this time I could see a range developed in the POC region and was sitting on my hands keeping powder in my last bullet dry. I waited till the US cash open and some initial indecisiveness, and then saw DAX taking a turn lower, with ES going lower as well. We broke consolidation and then took out lows and printed momentum candles on so decent volume.

So I have decided to look for a short entry in the momentum market. The setup came along soon.

We've got a contracting triangle, lower highs, then a break of a pullback TL. I put my order in more aggressive not wanting trade to get away from me. But it came roaring into the red and quickly stopped me out and proceeded higher.

That was the end of trading today.

I went for a walk. When I came back and checked the market, I could see next two entries were all niceness and first would give 25 ticks and second was good for 60. Volatility had reduced and entries were low risk.

Here is what I am taking from today:

1. While I might have had some confusion on direction today (and no wonder - a tough cracker of a day), I took trade in a disciplined fashion, as per technical setup and did not run a scary chicken. I was cool, my heart rate wasn't rising much (last week my pulse was all over the place when taking trades)

2. I started to implement my goal for this week - take all system trades, do not run for cover too soon (until we have an impulse in a right direction), stay cool

However there is something I need to consider:

1. Filter out excessive volatility and don't enter when market is giving very broad entry sketches like today requiring maximum risk even to get in, wait for a market to settle

2. Don't take two trades one after another too soon, unless you are getting into the same setup after a fake out stop-run and setup is confirming its validity. Otherwise - wait for an hour or wait for a next session.

3. If market is not cooperative - leave the last shot for the evening session, after the european markets close, price action becomes less volatile and usually gives some cleanest setups, while slow, that might run full distance to 60 ticks profit target.

In general I do feel good even if I lost 800 usd today. It reminds me why I should not run scared and protect too soon, take meager profits when market is going my way and instead sit through the trades and take large profits. It is to pay for the days like today when nothing seems to work and most moves are stop runs.

There will be another day tomorrow. I will prevail and come on top of this thing once again.