Finally I am putting an end on this frustrating week. I tried something very difficult, wasn't totally a failure but just doesn't fit the parameters I put in. I am talking about working out a system to fade moves in gold with limit orders and very small stops. I can do ok with it using stops like 10 ticks, but it's hard to expect moves of 20-30 ticks regularly from these setups to justify this risk, also several consecutive losses are very probably.

Instead I have decided today to focus on staying with the force of order flow, entering on failing pull backs with stop orders and small stops, using compressed price action and a trigger.

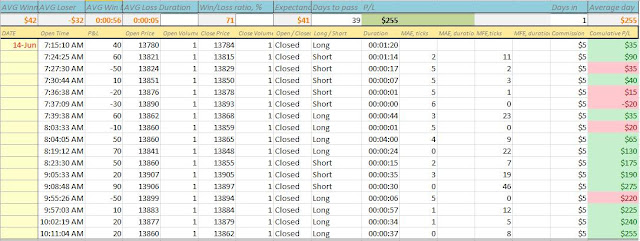

Here is few screenshots of my trials today. I plan to continue next week with this type of setups. I will write a formal plan here later on today.

Friday 21 June 2013

Tuesday 18 June 2013

Traded a hell lot on practice today. Since volume was bad again and hardly any orderly trading was expected I was shooting different trade ideas from the hip. 35 trades or so. Some good, some bad and some evil. Obviously down a lot and long series of losing trades. Low volume day obviously exaggerated it a lot, but it is a good thing: too good day may get you into believing that inferior setups work better than their average expectation. Sure, setups did work today too, but generated sequences of losses that would be insane to trade live with even if a good winner would pay off a large chunk of it. Scalping gold with a small stop is not a viable option, something I have proven for myself today. So I can put a stop finally on streaks of trade ideas I am having all the time. For me gold is great to trade with momentum when present, but pretty much nothing else. When gold is not moving fast it is largely chaotic, and while it is still possible to trade it will require a larger stop loss to sustain chaotic ticking up and down. This makes bringing to break even very hard with gold - you get stopped by the weird tick and then it moves away. So the best to trade gold is when it is moving unidirectionally. Then it is most orderly and entries and stops make more sense. Avoid any areas when it stops and just hang in there. Better to bail at BE, it gives opportunities to bail often enough. It should move fast or bail.

So this is something I will practice starting tomorrow:

1. My main setup, look to improve entry and fill given the good order flow, or fade the level if order flow is weak on approaching

2. Mark the key levels, after they worked and price is through, look to fade price action it these points, assuming order flow is not strong on approach, and that level significance is reinforced with mean-reverting pressure, so the best entries are coming from price action spiking through the keltner channel (or BB or something similar, based on statistical distribution)

3. Fade price on VWAP like given that market has a bias and VWAP is skewed from the VPOC, so the volume area is skewed towards market direction, in this case VWAP fade can get me in for the huge ride, check if 10 ticks stop will be better. Risk reward can be 10:1 on a trade like this. Also run few weeks worth of charts checking possible historic VWAP setups and what stops were working. Consider using up to 20 ticks stop for initial entry. Adding to the position can be done at breaking through the key level.

This is 3 simple ideas, I need to work them out to perfection. Rinse and repeat.

So this is something I will practice starting tomorrow:

1. My main setup, look to improve entry and fill given the good order flow, or fade the level if order flow is weak on approaching

2. Mark the key levels, after they worked and price is through, look to fade price action it these points, assuming order flow is not strong on approach, and that level significance is reinforced with mean-reverting pressure, so the best entries are coming from price action spiking through the keltner channel (or BB or something similar, based on statistical distribution)

3. Fade price on VWAP like given that market has a bias and VWAP is skewed from the VPOC, so the volume area is skewed towards market direction, in this case VWAP fade can get me in for the huge ride, check if 10 ticks stop will be better. Risk reward can be 10:1 on a trade like this. Also run few weeks worth of charts checking possible historic VWAP setups and what stops were working. Consider using up to 20 ticks stop for initial entry. Adding to the position can be done at breaking through the key level.

This is 3 simple ideas, I need to work them out to perfection. Rinse and repeat.

Testing continues

Generally a very low volume day, lack of participation, the strategies I tested require more normalized trading activity thus did not work. Still I could get a couple less losers in the beginning of session by applying filters. However losses will be ever present, so the question is not how to minimize them by any means and costs, but how to still take winners. Some of my break even trades could be winners. Since I target minimum 3:1 reward to risk, perhaps I should concentrate not to pass on a winner instead of protecting trade by any means. I will test a time based break even approach - only putting to break even about one minute after, if price action remains in the region of entry - move a limit there to get out. If price action moved away - do not put to break even until one test of the entry. If price action moved away to profit - look for potential scale-in entries, and prace original stop where I would place a stop for a scale-in entry. This won't work for 15 ticks profits, but I plan to capture much larger runs like 30-50 ticks too. For 15-tick profits only use break even as per rules above, because I will get stopped out of many profitable trades.

Saturday 15 June 2013

Got funded by TopStepTrader

It's official now! I have received a status of funded trader with TopStepTrader prop firm. My new funded account is yet to be available, can take few weeks to sort things out, but it's official. Now I have got my live trader practice account, so I can score on demo in same way replicating approach I will be taking live.

I am a proponent of slowly does it, so despite having a max buying power of 15 contracts, I will be starting with one and will earn the right to use more, by adding 500 usd to my live real money account for each new contract to be available to use.

I have traded first day with that approach in mind. I did not use my main strategy at all, it's well developed and I know what it can and can't do, however I concentrated on development of some trade ideas. I consider results of the first day to be good. I did several trades I would not consider repeating and some I consider well done. I have formulated a sound plan on protecting a trade and conditions when it is essential to let trade run.

I plan to add this strategy to my live strategies list, and will hold off with another ones from my development list. I believe these two has maximum potential. Having more than 3 live strategies will overcomplicate things and likely diminish my performance.

I plan to practice new strategy until I receive a new account, so about 2-3 weeks. Since it's a day trading strategy that can generate 5-10 setups per day, it's enough to produce dependable data set for analysis and modifications before taking it live.

I am a proponent of slowly does it, so despite having a max buying power of 15 contracts, I will be starting with one and will earn the right to use more, by adding 500 usd to my live real money account for each new contract to be available to use.

I have traded first day with that approach in mind. I did not use my main strategy at all, it's well developed and I know what it can and can't do, however I concentrated on development of some trade ideas. I consider results of the first day to be good. I did several trades I would not consider repeating and some I consider well done. I have formulated a sound plan on protecting a trade and conditions when it is essential to let trade run.

I plan to add this strategy to my live strategies list, and will hold off with another ones from my development list. I believe these two has maximum potential. Having more than 3 live strategies will overcomplicate things and likely diminish my performance.

I plan to practice new strategy until I receive a new account, so about 2-3 weeks. Since it's a day trading strategy that can generate 5-10 setups per day, it's enough to produce dependable data set for analysis and modifications before taking it live.

Monday 10 June 2013

Worked over the weekend on identifying additional setups, totalled 5 overall but it is overkill, will be hard to manage risk. Still identified some, might be also interesting to test out on ES. Will venture further into this field this week. At some points ES can be move relatively fast, which is good. Gold is too fast to work with any not pre-set orders

Wednesday 5 June 2013

Some more trading live today on my personal real account.

Some more trading live today on my personal real account.

Another attempt to jump on the bandwagon (low volume market again!), now placed entry not below the sell level but right on it to minimize the slippage, still got slipped 6 ticks on 8 ticks pop. Not good. And there was no real strong selling pressure. Have to blame illiquid market.

Now, I do find more and more attractive to just trade around those levels before the pop and after the pop, instead of during the pop. I lost 5 ticks on the pop trade, stop was 2 but got slipped 3 ticks on exit but I faded the level on retest, too bad I tried it on somewhat 3rd retest, price moved my way like 5 ticks and BE was put but went back, stopped at BE and slipped 1 tick, so another -1. Price moved above with some buying pressure, so I faded the move down to the level again and netted 15 ticks. During this move my internet went off, so it was a moment of tension. Still on mobile tethering access. But this seems to be a nicer way to trade my levels. Here Jigsaw tools come to real life, as market trades much slower outside of events, and ladder number are a big help actually, so are real traded contract numbers and added/removed limits.

but I faded the level on retest, too bad I tried it on somewhat 3rd retest, price moved my way like 5 ticks and BE was put but went back, stopped at BE and slipped 1 tick, so another -1. Price moved above with some buying pressure, so I faded the move down to the level again and netted 15 ticks. During this move my internet went off, so it was a moment of tension. Still on mobile tethering access. But this seems to be a nicer way to trade my levels. Here Jigsaw tools come to real life, as market trades much slower outside of events, and ladder number are a big help actually, so are real traded contract numbers and added/removed limits.

Another attempt to jump on the bandwagon (low volume market again!), now placed entry not below the sell level but right on it to minimize the slippage, still got slipped 6 ticks on 8 ticks pop. Not good. And there was no real strong selling pressure. Have to blame illiquid market.

Now, I do find more and more attractive to just trade around those levels before the pop and after the pop, instead of during the pop. I lost 5 ticks on the pop trade, stop was 2 but got slipped 3 ticks on exit

but I faded the level on retest, too bad I tried it on somewhat 3rd retest, price moved my way like 5 ticks and BE was put but went back, stopped at BE and slipped 1 tick, so another -1. Price moved above with some buying pressure, so I faded the move down to the level again and netted 15 ticks. During this move my internet went off, so it was a moment of tension. Still on mobile tethering access. But this seems to be a nicer way to trade my levels. Here Jigsaw tools come to real life, as market trades much slower outside of events, and ladder number are a big help actually, so are real traded contract numbers and added/removed limits.

but I faded the level on retest, too bad I tried it on somewhat 3rd retest, price moved my way like 5 ticks and BE was put but went back, stopped at BE and slipped 1 tick, so another -1. Price moved above with some buying pressure, so I faded the move down to the level again and netted 15 ticks. During this move my internet went off, so it was a moment of tension. Still on mobile tethering access. But this seems to be a nicer way to trade my levels. Here Jigsaw tools come to real life, as market trades much slower outside of events, and ladder number are a big help actually, so are real traded contract numbers and added/removed limits.Saturday 1 June 2013

Latest notes

I've been fiddling with this project for a while recently before I completely lost last interest in retail forex market and completely moved into futures day trading. My post can be found here: http://fxalgo.net/

Back again!

Hey I am back again to my blog. There is a lot of news to tell, but let's do that slowly. I am trading futures markets now exclusively and going through the process with a recruiting agency TopStepTrader in order to qualify to trade Other People Money.

Subscribe to:

Posts (Atom)